Mortgage amortization may sound complicated, but it’s actually a process that makes buying a home easier.

Put simply, amortization means you’re paying off your home loan according to a schedule that determines your monthly payment, and how each payment is divided between principal and interest. This lets you pay back your mortgage via steady payments with a known end date, instead of having to come up with a large sum all at once.

Understanding amortization helps you track the home equity you’re building as you pay off your loan, and reliably budget for the future.

How Mortgage Amortization Works

Your amortization schedule will lay out how much you need to pay each month to repay your mortgage balance and all the interest by the end of the loan term.

When you make your monthly payment, part of it goes toward reducing the principal, and part of it goes toward paying interest. When you first begin to pay your mortgage, most of your monthly payment is dedicated to interest — which means it takes longer to build equity in your home. Near the end of your loan term, most of your monthly payment will be dedicated to the principal, and your loan balance will decrease more quickly.

Your monthly payment also may include homeowners insurance and property taxes, which can change over the course of your loan term and cause your payment amount to fluctuate.

How To Calculate Mortgage Amortization

You can request an amortization schedule from your mortgage lender or generate a sample amortization table using an online calculator.

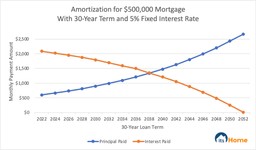

Here’s a sample amortization schedule for a 30-year fixed-rate mortgage with a $500,000 principal and a 5% interest rate:

Amortization Schedule for $500,000 Mortgage With 30-Year Term and 5% Fixed Interest Rate

| Month | Payment | Interest | Principal | Principal Balance | Total Interest Paid |

| 0 | – | – | – | $500,000 | $0 |

| 1 | $2,684 | $2,083 | $601 | $499,399 | $2,083 |

| 2 | $2,684 | $2,081 | $603 | $498,796 | $4,164 |

| 3 | $2,684 | $2,078 | $606 | $498,190 | $6,242 |

| 4 | $2,684 | $2,076 | $608 | $497,582 | $8,318 |

| 5 | $2,684 | $2,073 | $611 | $496,971 | $10,391 |

| 6 | $2,684 | $2,071 | $613 | $496,358 | $12,462 |

| – | – | – | – | – | – |

| 355 | $2,684 | $66 | $2,618 | $13,253 | $466,113 |

| 356 | $2,684 | $55 | $2,692 | $10,624 | $266,168 |

| 357 | $2,684 | $44 | $2,640 | $7,984 | $466,212 |

| 358 | $2,684 | $33 | $2,651 | $5,334 | $466,245 |

| 359 | $2,684 | $22 | $2,661 | $2,672 | $466,267 |

| 360 | $2,684 | $11 | $2,672 | $0 | $466,278 |

This amortization table shows that you’d pay $466,278 in total interest. Combined with the $500,000 principal, that means you’d pay $966,278 overall.

Here’s an amortization chart showing how your monthly payment would be divided between principal and interest over the life of the loan:

Long vs. Short Amortization Schedules

According to Freddie Mac, nearly 90% of homebuyers choose a 30-year fixed-rate mortgage. However, another option is selecting a 15-year mortgage and paying off your home loan in half the time.

A longer amortization schedule gives you more time to pay off the loan, which means a lower monthly payment but more interest paid overall. A shorter schedule means a higher monthly payment, but you’ll pay less in interest.

If you’re looking for something in the middle, many types of lenders offer custom loan terms.

Pros and Cons of Long vs. Short Amortization Schedules

| Longer Amortization Schedule | Shorter Amortization Schedule | |

| Pros | Lower monthly payments.More room in your monthly budget. | You’ll pay less interest.You’ll build equity faster. |

| Cons | You’ll pay more in overall interest.You’ll build equity slower. | Higher monthly payments.You’ll have less money available for the rest of your budget. |

Why Mortgage Amortization Is Important

Wrapping your head around mortgage amortization can be useful for several reasons:

- Know how much equity you have. Your amortization schedule can help you keep up with how much equity you’re building in your home, which will be important if at any point you want to use your home equity to take out a home equity loan or a home equity line of credit, or do a cash-out refinance.

- Determine when you can stop paying for private mortgage insurance. If you take out a conventional loan with a down payment that’s less than 20% of the purchase price, then you’ll need to pay for PMI. Your amortization schedule tells you when your equity will pass the 20% mark, and when you can stop paying for PMI.

- Accelerated payment options. If you have extra income and want to build equity faster, you can pay more and have it applied to the principal. For example, paying an extra $100 each month on a 30-year fixed-rate mortgage for $500,000 with a 5% interest rate could save you $42,599 in overall interest and pay off your loan more than two years ahead of schedule.

Amortization by Interest Rate Type

Mortgage amortization works a bit differently depending on what type of interest rate you have:

- Fixed-rate mortgage. With a fixed-rate mortgage, your interest rate won’t change. That means your monthly payment will be the same throughout the life of your loan.

- Adjustable-rate mortgage. With an ARM, your interest rate will change at specific intervals, which means your monthly payment also will change. Your lender will modify your amortization schedule each time your interest rate adjusts to ensure your loan remains on schedule to be repaid at the end of the loan term.

Mortgage Amortization FAQ

Here are answers to some frequently asked questions about mortgage amortization.